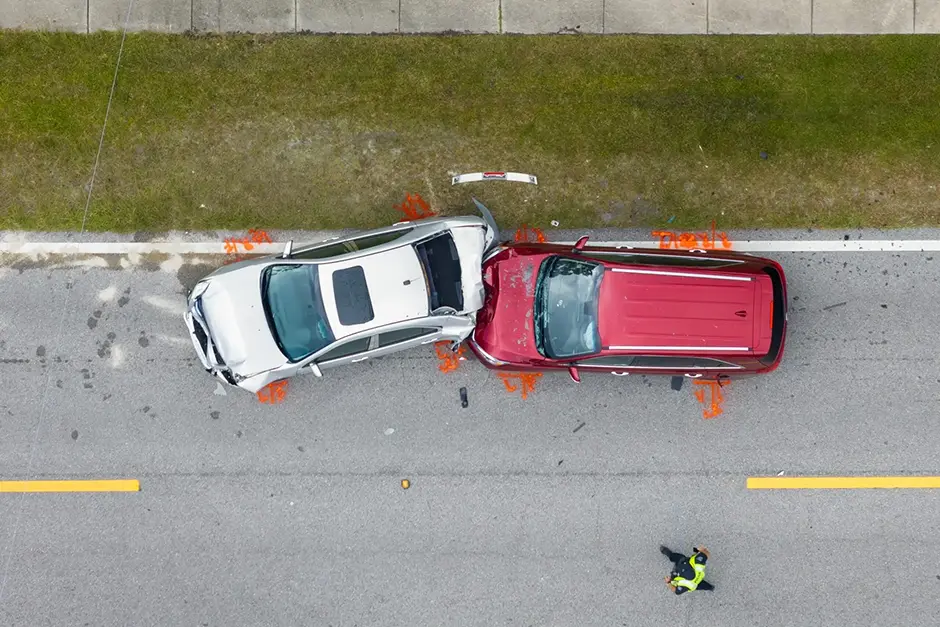

Accidents are already stressful. They’re even more complicated if an uninsured driver hits you or you don’t have auto insurance coverage. Having car insurance helps soften the financial blow that comes from an accident. Without it, you may spend out of pocket, with expenses possibly running into tens of thousands of dollars, and you could also face penalties. So, how do you protect yourself legally? Here’s everything you need to know.

Implications of Being Uninsured in an Accident

Here’s what to expect in a car accident with no insurance.

At-fault vs. Not-at-fault Accidents

Your liability as an uninsured driver in a car accident depends largely on whether you’re at fault, and if you are, the consequences can be severe. The court may hold you liable for the damages in a personal injury lawsuit. But it doesn’t end there, as you may still face some legal penalties.

If you’re not at fault, there are still repercussions for driving without insurance. Law enforcement may impound your vehicle and suspend your driver’s license. You may also lose your right to recover damages for your injuries in some states.

Potential Civil Lawsuits

Can you be sued in a car accident? The answer is yes. The other driver may file a personal injury lawsuit against you and claim damages. If the court holds you liable for the accident, it means it believes you caused it. And you could be required to cover the following damages:

- Cost of repairs or replacement

- Medical bills

- Pain and suffering

- Lost income

If it’s a no-injury auto accident, you’ll only cover the cost of property damage.

Criminal Charges and Legal Repercussions

Driving without insurance is illegal in every U.S. state except New Hampshire. So, you may face legal consequences even if you’re not at fault. In some states, the police can tow your car if you’re uninsured and you’re involved in a crash even if you’re not at fault. Your license may be suspended and you may pay fines. Repeat offenders may face jail time.

Out-of-pocket Expenses for Damages

If the court holds you liable for causing the accident, as an uninsured driver, you’ll pay for the damages out of pocket. This may include economic damages, such as the cost of medical bills and of repairing or replacing the car, and non-economic damages like pain and suffering. Repair costs can skyrocket, potentially reaching $10,000 or more if the vehicle is severely damaged.

Understanding State Insurance Requirements

Each state has specific laws about the minimum insurance required to drive legally and who is responsible after an accident.

Variations in Insurance Laws Across States

U.S. states have different insurance laws:

- No-fault vs fault: In at-fault states, such as Alabama, Texas, Louisiana, and Georgia, the driver who causes an accident is responsible for the other driver’s damages and injuries. In no-fault states, such as Kentucky, New Jersey, and Pennsylvania, drivers file bodily injury claims with their own insurance company.

- Personal insurance protection (PIP): This insurance covers any medical expenses and lost wages you suffered from a crash whether you are to blame or not. PIP coverage is mandatory in some states, especially no-fault states.

- Uninsured/underinsured motorist coverage (UM/UIM): This covers losses such as medical bills and medical repairs if you’re involved in an accident caused by a driver with no or insufficient insurance coverage. Some states require one or both, and some don’t require either one.

Minimum Coverage Requirements

In every state except New Hampshire, drivers must carry minimum insurance coverage and show proof of insurance if a law enforcement officer asks for it. Minimum coverage generally covers bodily and property liability.

The insurance amount varies among various states. Louisiana has 15/30/25 liability limits, which provide payments of $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $25,000 coverage for damage to another person’s vehicle or other property. In Texas, it’s 30/60/25 — at least $30,000 in liability coverage per person, $60,000 per accident, and $25,000 for property damage per accident. The minimum coverage in some states, such as Kansas, also includes personal insurance protection and uninsured/underinsured motorist coverage.

Importance of Uninsured Motorist Coverage

A report by the Insurance Research Council shows that in 2022, 14% of U.S. drivers were uninsured. In Texas, the figure is estimated to be 20%.

If you have uninsured motorist coverage, your insurance company will cover any cost of bodily injuries or property damage to you and your passenger by uninsured drivers.

Steps to Take After an Accident Without Insurance

There are things you shouldn’t do after a car accident. However, there are specific things you should do to protect your rights:

Gather Evidence at the Scene

Get evidence that will help prove your case. Take photos of the accident scene, any injury, and property damage. Collect the contact information of the other driver, write down the account of anyone who witnessed the crash, and take down their contact information.

Report the Accident to Authorities

Report the accident to law enforcement and get a police report, which can help prove your car accident insurance claim. Also, most state laws require you to report auto accidents to the police and the Department of Motor Vehicles if there are injuries or significant property damage.

Notify Potentially Involved Parties

If the accident damages the property of a party who is not on the scene, you must inform them as soon as possible. You can do so by writing your contact details in a note and placing it where they can see it. In some states, including Texas, it’s an offense to leave an accident scene without giving the other driver and other interested parties information about you. [Texas Transportation Code Ann. § 550.024]

Penalties for Driving Without Insurance

Driving without insurance causes both legal and financial problems:

- Fines and legal consequences: You may pay a fine in addition to the police impounding your car. Also, if you caused a collision resulting in death or severe injuries, you may face higher fines and even jail time.

- Points on driving record: Having points on your driving record may drive up your insurance premiums because insurance companies see you as risky.

- Possible license suspension: In some states, your license will be suspended or revoked. To reinstate it, most states require you to file an SR-22 form. This is a document from your insurance company to your state’s Department of Motor Vehicles confirming that your insurance meets the state’s minimum coverage.

Options for Recovering Compensation

There are several ways to recover compensation from the at-fault party in a no-car insurance car accident:

- If you have health insurance, you can file a claim with your insurance company for injuries you sustained in an auto crash.

- You can sue the at-fault driver directly if they have resources you can use to collect judgment. However, the person may attempt to frustrate the case by filing for bankruptcy.

- To give you a better chance of recovering something, your best option may be to negotiate a settlement and draw up a payment plan. This also helps you to save costs and avoid a lengthy court process.

Role of Legal Representation

A lawyer specializing in no-insurance car accidents can help you in several ways:

Benefits of Hiring a Lawyer

Whether you want to file a claim or defend a lawsuit, a car accident lawyer can explain your legal options and help you choose the best way to prove or defend your claim. This may involve negotiating with insurance companies or representing you in court.

Understanding Your Rights

An experienced no-insurance car accident lawyer can help you understand the likely outcome of your case and advise you on the right steps to take.

Navigating the Legal Process

The legal process for car accidents with no insurance is complex. However, a knowledgeable car accident lawyer who has handled similar cases as yours can guide and support you, especially when there’s the possibility of penalties or you’re facing a lawsuit.

An attorney can help you gather evidence to prove your case, negotiate with the other party, draw up a settlement plan, and represent you in court if there’s a trial.

Car Accident with No Insurance FAQs

We answered commonly asked questions on car accidents with no insurance.

What if the car that hit me has no insurance?

If the driver that hit you was uninsured, you can still file a lawsuit against them and recover damages. Alternatively, you can file a claim with your insurance company if you have personal insurance protection or uninsured motorist coverage.

Can you go to jail for driving without insurance?

You will not go to jail for simply driving without insurance. However, it’s possible if you cause a crash resulting in death or serious bodily harm.

What happens if you get into a car accident without insurance in Louisiana?

If you were at fault, you will be liable for the other driver’s medical bills, car repairs, and property damage. Even if the accident wasn’t your fault, Louisiana’s No Pay No Play law bars you from receiving the first $15,000 of any injury costs or $25,000 in property damage from the other driver’s insurance. In both cases, you might also face fines ranging from $500 to $1,000, your driver’s license may be suspended, and your car may be impounded. To drive legally again, you would need to get an SR-22 certificate.

What happens if you get into a car accident without insurance in Texas?

If you’re at fault, the other party can sue you and claim liability. If they succeed, you’ll pay them damages, including the cost of medical bills, lost wages, and property damage out of pocket. If you were not responsible, you can recover damages from the other party. However, you may pay a fine of $175 to $350.

Navigating a Car Accident Without Insurance

Being involved in a car accident without insurance can be complex and overwhelming. You may face penalties and huge financial costs, and it’s more severe if you’re at fault. Consult an experienced car accident lawyer as soon as possible, and don’t try to handle it yourself. Our car accident attorneys at Morris & Dewett Injury Lawyers are ready to help you fight to protect your rights and interests. Contact us if you want experienced and dedicated legal representation.